In the world of professional sports, the sale of a team is typically a straightforward, if monumental, business transaction. An owner decides to sell, a buyer makes an offer, and pending league approval, the torch is passed. But for the WNBA’s Connecticut Sun, this familiar process has morphed into a bewildering saga of corporate obstruction and financial demands that seem to defy logic. The team’s owners, the Mohegan Tribe, are ready to move on. The problem? The WNBA is reportedly refusing to let them, creating a standoff that has left the franchise’s future shrouded in uncertainty and sparked a debate about the league’s motives and methods during a pivotal era of growth.

At the heart of the issue is a strange and unyielding condition allegedly set by the league office. According to reports, the WNBA is blocking the sale of the Sun to any ownership group that did not formally submit a bid during the league’s recent expansion process. This immediately threw cold water on a promising deal that would have sent the team to a group in Boston. Neither Boston nor another potential destination, Hartford, Connecticut, were part of the official expansion race. The league’s logic appears to be that new cities must enter through the formal, and lucrative, expansion channel. But by applying this thinking to an existing team’s sale and relocation, the WNBA has effectively painted the Sun’s current owners into a corner.

The situation grows more complex and, frankly, more bizarre when examining the league’s supposed preferred outcome. Sources suggest the WNBA is pushing for the team to be sold to an ownership group in Houston, led by Rockets owner Tilman Fertitta. While Houston is a viable market, the financial structure of such a deal is staggering. The Houston group would reportedly have to pay the Mohegan Tribe around $300 million for the franchise. On top of that, they would be required to pay the WNBA an additional “relocation fee” estimated to be between $100 million and $150 million.

This brings the total cost to acquire and move the Sun to somewhere between $400 million and $450 million. To put that figure in perspective, the reported fee for a brand-new expansion team is $250 million. Why would any investor pay nearly double the price for an existing team when they could, in theory, wait a few years and get a new franchise for significantly less? It’s a question that analysts and fans are asking, and the answer seems to point toward a league hungry for immediate cash infusions. The WNBA appears to be leveraging the sale of the Sun to extract an expansion-level fee from a market that wasn’t part of the official expansion process, regardless of whether it makes sound business sense for the buyer.

This aggressive financial posture is predicated on a belief in sustained, exponential growth, a risky bet in any industry. While the WNBA has seen a phenomenal surge in popularity, assuming that franchise valuations will continue to double or triple every few years is a dangerous gamble. The sports world is cyclical, and major media rights deals, like the one the NBA and WNBA are banking on, do not always increase. Some analysts predict the next TV deal might even be lower than the current one, which would deflate franchise values across the board. To demand a $450 million investment today based on a future that is anything but guaranteed strikes many as a shortsighted strategy.

However, the most baffling component of this entire affair is the league’s definition of “relocation.” The Mohegan Tribe, which has been a steadfast operator of the Sun for years, owns the Mohegan Sun Arena in Uncasville where the team plays. A logical move, if a new Connecticut-based owner were to purchase the team, would be to the state’s capital, Hartford, just a 45-minute drive away. This would keep the team in its home state, retain its fanbase, and presumably keep the “Connecticut Sun” identity intact.

Yet, the WNBA is reportedly insisting that even this 40-mile move would trigger the massive, undisclosed relocation fee. This is where the league’s position moves from aggressive business tactics to outright absurdity. In what other context is moving a business from one city to another within the same state, in the same media market, considered a full-scale relocation worthy of a nine-figure fee? It’s akin to telling the Los Angeles Clippers they needed to pay the NBA a relocation fee for moving from the Crypto.com Arena to their new Intuit Dome in Inglewood, just a few miles away. The team is still the Connecticut Sun. The fans are still in Connecticut. The only thing changing is the arena.

This demand suggests the WNBA is not concerned with the geographical integrity of a franchise but is instead focused on one thing: the fee. The league seems to have decided that any team that plays in a new arena, regardless of location, must pay for the privilege. It’s a move that transforms a simple change of venue into a prohibitive financial penalty, effectively preventing any local solution to the Sun’s ownership situation.

This leaves the Mohegan Tribe in an impossible predicament. They are attempting to conduct a responsible sale of their asset. They have reportedly found a willing buyer in the Boston group, which offered a respectable $325 million. But the league has blocked that path. They are being pushed toward a Houston deal that is financially illogical for the buyer. And they are being told that even a simple, in-state move is off the table without paying a king’s ransom to the league. The net result is that the Mohegan Tribe may be unable to sell the team at all. They own the arena, practice facilities, and the entire infrastructure, yet they are being held hostage by the very league they have long supported.

This entire episode raises serious questions about WNBA governance and its relationship with its owners. The reported involvement of NBA Commissioner Adam Silver suggests this hardline stance may come from the highest levels of professional basketball leadership. Are the leagues so focused on maximizing short-term revenue that they are willing to alienate loyal owners and create rules that stifle, rather than facilitate, healthy business transitions? By creating such a hostile environment for a team sale, the WNBA risks sending a chilling message to both current and future investors.

The Connecticut Sun, a team with a dedicated fanbase that sells an impressive 92% of its tickets, deserves a clear path forward. The Mohegan Tribe, after years of stewardship, deserves the right to sell their asset in a fair and logical market. Instead, they are caught in a web of financial demands and bureaucratic red tape. This is no longer just a business deal; it’s a battle over control, precedent, and the fundamental principles of how a professional sports league should operate. The future of the Connecticut Sun hangs in the balance, and how the WNBA resolves this self-inflicted crisis will say a great deal about the league’s vision for its future.

News

WNBA Coach Ejected After Shocking On-Court Confrontation Following Controversial Non-Call

The air in the arena was thick with frustration and the kind of tension that can only build in the…

THE UNANNOUNCED EXODUS—WHO GOT BOOTED FROM ‘THE FIVE’ AS SANDRA SMITH TAKES OVER IN SHOCKING POWER GRAB?

The world of cable news, a landscape already defined by its daily turmoil and high-stakes drama, has been sent into…

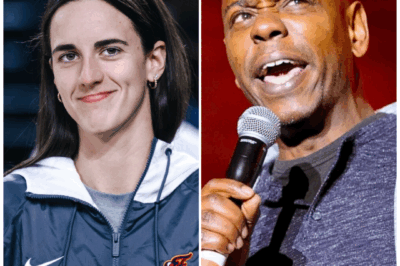

Don’t get so caught up in Caitlin Clark’s hype that you forget about another WNBA sensation – JuJu Watkins!

In the electrifying universe of women’s basketball, two names are spoken with reverence, fear, and an almost religious fervor: Caitlin…

More Than A Win: A’ja Wilson’s Shocking Candor Reveals The Standard of a Champion

Victory in sports is supposed to be simple. It’s a binary outcome—a mark in the win column, a step up…

A Champion’s Rebuke: A’ja Wilson’s Viral Comment Exposes the Uncomfortable Truth Behind a Winning Streak

In the carefully managed world of professional sports, athletes are often trained to speak in platitudes. They talk of giving…

A League in Denial: The Brutal Truth Behind the WNBA’s Battle for Respect

A Costly Charade: Why the WNBA’s Demands for Respect Ring Hollow For decades, the Women’s National Basketball Association has been…

End of content

No more pages to load