Trouble Under the Hood: BYD Faces Allegations of Financial Misconduct Amid Deepening EV Woes

Chinese electric vehicle titan BYD is under intense scrutiny following a wave of allegations that the company has been manipulating its financial reporting to hide massive losses in its EV business. Despite a public image of rapid growth and technological prowess, a deeper look at its 2024 financials — and behavior in the marketplace — paints a more troubling picture.

The core accusation? That BYD has been faking profitability by merging the results of its loss-making electric vehicle division with its highly profitable battery supply business, giving investors a misleading sense of financial health.

The Numbers That Don’t Add Up

According to BYD’s official 2024 report, the company posted a 32.9% increase in net profit, totaling 41.6 billion yuan (approximately $5.7 billion), and recorded total revenue of 777 billion yuan. On the surface, this suggests a healthy 5.4% profit margin — more than double the Chinese manufacturing industry average of 2%.

But critics argue that this topline figure is highly misleading.

Analyst Lei, whose financial breakdown of BYD’s books has gone viral in recent weeks, claims the company is propping up its EV business with income from its separate — and extremely profitable — battery supply operations. Rather than reporting electric vehicle losses separately, BYD appears to be bundling these under a murky accounting category: “Automobiles and related products and other products.”

This category may include both vehicle sales and battery cell revenues, making it nearly impossible to determine how profitable — or unprofitable — BYD’s electric vehicles actually are.

“If I were trying to hide losses from EV sales,” one analyst remarked, “this is exactly how I’d do it.”

Selling at a Loss?

The most damning evidence comes from BYD’s own sales and pricing trends.

In China, the company has been offering steep discounts — as high as 35% — on vehicles that were already among the cheapest EVs on the market. Many BYD cars sell for around 124,900 yuan, or roughly $17,400. After factoring in taxes and production costs, the estimated gross profit before overhead per vehicle is about 19,500 yuan ($2,700).

But once so-called “hidden costs” are included — estimated at 20,000 yuan per vehicle — BYD is likely losing money on every EV it sells. This estimation is based on the company’s 2024 performance, before it began offering massive new discounts in early 2025.

The result: a business that looks profitable on paper, but may be in the red where it matters most.

Delayed Payments, Rising Inventory

Other warning signs are piling up. According to reports from Chinese media and sources close to the company, BYD has recently slowed down production at several factories and delayed expansion plans. The company is also reportedly taking as long as 12 months to pay some suppliers — a move that raises serious liquidity concerns.

At the same time, inventory is climbing, despite aggressive price cuts. This suggests weakening demand — even at deeply reduced prices.

“Think about this,” said one observer. “They’re struggling to sell EVs with decent specs for the equivalent of $10,000 — and still have to slash prices by 20 or 30%. That’s a giant red flag.”

Too Many Models, Too Little Focus

Another key issue is operational complexity. BYD markets over 20 different vehicle models — far more than competitors like Tesla, which relies on a few category-defining vehicles to dominate the EV market.

This model overload makes BYD less efficient and dilutes its economies of scale. Combined with thin margins and high costs, the complexity could be weighing heavily on the company’s ability to stay profitable in its core business.

Analysts say this is a stark contrast to Tesla, which sells the Model Y — the best-selling vehicle in China — at prices two to three times higher than many BYD offerings, and still turns a profit.

Are BYD’s EVs Really Electric?

Another contentious issue involves how BYD reports its “electrified” vehicle sales. Despite earlier announcements that it had stopped producing internal combustion engine (ICE) vehicles, many of its so-called electric cars are actually hybrids with tiny batteries — some so small they barely qualify as EVs.

Critics have labeled them “trans EVs” — ICE vehicles in disguise — and argue that this classification inflates BYD’s electric sales figures while undermining its credibility in the global EV race.

What Lies Ahead?

The mounting skepticism around BYD comes at a critical moment. The global electric vehicle market is rapidly consolidating, and competition in China — the world’s largest EV market — is becoming brutally fierce.

Tesla’s dominance continues to grow, and other Chinese competitors such as NIO and Great Wall Motors, while also facing pressure, appear to be on more solid financial footing relative to their size. Tesla, for instance, has double the assets compared to liabilities, while BYD’s ratio is far tighter — raising questions about its long-term financial resilience.

If these allegations prove true, the implications could be seismic. Investors, suppliers, and regulators will be watching closely to see whether BYD can weather the storm — or whether this is the beginning of a larger unraveling.

In a market known for rapid rise and sudden collapse, the question looms large:

Is BYD the next great EV innovator — or the next Evergrande in the making?

News

WNBA Coach Ejected After Shocking On-Court Confrontation Following Controversial Non-Call

The air in the arena was thick with frustration and the kind of tension that can only build in the…

THE UNANNOUNCED EXODUS—WHO GOT BOOTED FROM ‘THE FIVE’ AS SANDRA SMITH TAKES OVER IN SHOCKING POWER GRAB?

The world of cable news, a landscape already defined by its daily turmoil and high-stakes drama, has been sent into…

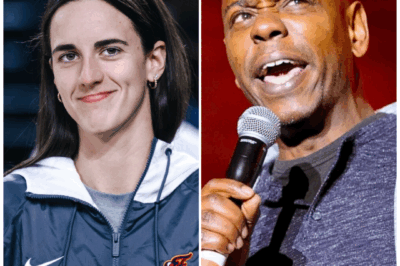

Don’t get so caught up in Caitlin Clark’s hype that you forget about another WNBA sensation – JuJu Watkins!

In the electrifying universe of women’s basketball, two names are spoken with reverence, fear, and an almost religious fervor: Caitlin…

More Than A Win: A’ja Wilson’s Shocking Candor Reveals The Standard of a Champion

Victory in sports is supposed to be simple. It’s a binary outcome—a mark in the win column, a step up…

A Champion’s Rebuke: A’ja Wilson’s Viral Comment Exposes the Uncomfortable Truth Behind a Winning Streak

In the carefully managed world of professional sports, athletes are often trained to speak in platitudes. They talk of giving…

A League in Denial: The Brutal Truth Behind the WNBA’s Battle for Respect

A Costly Charade: Why the WNBA’s Demands for Respect Ring Hollow For decades, the Women’s National Basketball Association has been…

End of content

No more pages to load