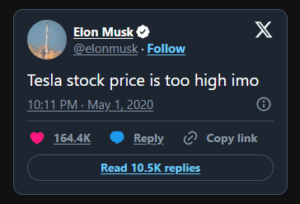

Elon Musk’s Six-Word Tweet That Erased $14 Billion—and the Chaos That Followed

It was a calm Friday morning in May 2020—until Elon Musk picked up his phone and sent out a tweet.

Just six words. No context. No warning. No filter.

“Tesla stock price is too high imo.”

That was it.

In an instant, Wall Street began to spiral. By the end of the day, Tesla’s stock had plunged more than 9%, wiping out over $14 billion in market value. Investors were stunned. Analysts were speechless. And the internet? Exploding.

But the tweet wasn’t just costly—it was controversial, reckless, and potentially a violation of a legal agreement Musk had made with the SEC just a year earlier.

A History of Pushing Boundaries

This wasn’t the first time Elon’s tweets stirred up trouble. In 2018, he tweeted that he had secured funding to take Tesla private at $420 per share. That move triggered a federal investigation and ultimately forced Musk to step down as chairman of Tesla. As part of the settlement, he agreed to have any Tesla-related tweets vetted by company lawyers before posting.

So when the Wall Street Journal asked if his “too high” tweet had been approved, Musk responded with a casual, almost defiant, “No.”

The backlash was immediate. Investors panicked. Legal experts raised red flags. And critics questioned whether the man behind the world’s most valuable EV company could—or should—continue playing so loosely with corporate communication.

Reckless or Calculated?

Some believe Musk knew exactly what he was doing. By publicly labeling the stock as overvalued, he triggered a selloff that brought Tesla’s share price back to what he considered a more realistic level.

But this wasn’t just about numbers—it was about trust.

How can investors feel safe if the CEO can torpedo the stock with a single tweet?

Fast Forward: A Rollercoaster That Paid Off?

For those who held onto their Tesla stock, the story didn’t end in tragedy.

In fact, quite the opposite.

Despite the $14 billion plunge, Tesla shares rebounded. Over the next five years, the company’s stock price soared by over 1,500%. Tesla’s expansion into robotics, Musk’s surprising rise to government leadership under Trump’s administration, and a regulatory environment leaning in his favor all fueled the rally.

But even as profits soared, so did controversy.

Crashing Into Reality: The Self-Driving Scandal

Just as Tesla began celebrating its robotaxi rollout in Austin, Texas, a disturbing video surfaced. In it, a Tesla vehicle equipped with Full Self-Driving (FSD) appeared to plow into a child-sized mannequin crossing the street. The footage, staged by advocacy group The Dawn Project, set social media ablaze.

Critics accused Tesla of putting innovation ahead of safety. The video showed the FSD vehicle failing to yield to a stopped school bus—then failing again to avoid the mannequin. It raised serious questions about whether Tesla’s tech was ready for the real world.

Dan O’Dowd, founder of The Dawn Project and a vocal Musk critic, didn’t hold back. “They just don’t care,” he said. “Safety has never been Elon’s priority.”

Tesla fans were quick to defend the company, pointing out the footage was part of a known anti-Tesla campaign. Others weren’t so sure. With multiple accidents already linked to Tesla’s driver-assist systems—including a fatal crash in 2024—concerns about safety are growing harder to ignore.

A Dangerous Game?

It’s hard to look away from Elon Musk. He’s brilliant. He’s unpredictable. And he’s redefining how tech giants operate—from Mars missions to robot factories.

But the question lingers:

At what cost?

When a six-word tweet can erase $14 billion…

When a self-driving car can’t detect a child…

When your CEO shrugs off safety as a secondary concern…

Is the future still thrilling—or just terrifying?

Tesla’s trajectory continues skyward. But for some, the ride no longer feels like progress—it feels like a gamble.

And Elon Musk? He’s still tweeting.

News

WNBA Coach Ejected After Shocking On-Court Confrontation Following Controversial Non-Call

The air in the arena was thick with frustration and the kind of tension that can only build in the…

THE UNANNOUNCED EXODUS—WHO GOT BOOTED FROM ‘THE FIVE’ AS SANDRA SMITH TAKES OVER IN SHOCKING POWER GRAB?

The world of cable news, a landscape already defined by its daily turmoil and high-stakes drama, has been sent into…

Don’t get so caught up in Caitlin Clark’s hype that you forget about another WNBA sensation – JuJu Watkins!

In the electrifying universe of women’s basketball, two names are spoken with reverence, fear, and an almost religious fervor: Caitlin…

More Than A Win: A’ja Wilson’s Shocking Candor Reveals The Standard of a Champion

Victory in sports is supposed to be simple. It’s a binary outcome—a mark in the win column, a step up…

A Champion’s Rebuke: A’ja Wilson’s Viral Comment Exposes the Uncomfortable Truth Behind a Winning Streak

In the carefully managed world of professional sports, athletes are often trained to speak in platitudes. They talk of giving…

A League in Denial: The Brutal Truth Behind the WNBA’s Battle for Respect

A Costly Charade: Why the WNBA’s Demands for Respect Ring Hollow For decades, the Women’s National Basketball Association has been…

End of content

No more pages to load