Steve Eisman Sounds Alarm on U.S. Banking “Cartel” as Mega-Banks Consolidate Market Power

Steve Eisman, the Wall Street icon best known for predicting the 2008 housing collapse, is warning that the United States may be sliding toward a dangerously consolidated banking system—one that could leave consumers with fewer choices and higher costs.

In a recent interview with The Compound, Eisman voiced concern that the nation is drifting toward a financial landscape dominated by a small group of massive institutions—most notably JPMorgan Chase and Wells Fargo. According to Eisman, the continued rise of these banking giants, paired with a regulatory environment that stifles mergers among smaller players, is driving America closer to a “cartel-like” system. “In 2007, JPMorgan’s share of deposits in the United States was 7%,” Eisman noted. “Today it’s close to 14%.”

That doubling of market share underscores a broader trend: fewer banks are controlling a growing portion of the nation’s financial infrastructure. This shift, Eisman says, is not solely the result of consumer preference but is largely driven by two key economic forces—regulatory burdens and technological costs. “The cost of regulation is very, very high,” Eisman explained. “And they [large banks] can bear that more easily. But even more important is the cost of technology—it has exploded, and you need to be really big to pay for it.”

As financial technology becomes more central to banking operations—ranging from mobile apps to cybersecurity and AI-driven fraud detection—smaller and mid-sized banks are finding it increasingly difficult to compete without substantial capital investments. Without the scale to spread these costs, many regional banks are losing ground or exiting the market altogether.

Eisman, a managing director at Neuberger Berman, believes the U.S. banking sector is in dire need of a new wave of mergers and acquisitions. Unlike the M&A booms of the 1990s, recent decades have seen relatively few consolidations, a trend that he says is no longer sustainable. “It’s been very much discouraged post-Dodd-Frank,” he said, referring to the financial reform legislation passed after the 2008 crash. “But I actually think as a country we need [a wave of M&A].”

The investor points to mid-sized institutions such as U.S. Bank and Comerica as potential merger candidates—institutions that, if combined, could have the scale needed to compete with Wall Street’s heavyweights. Without such moves, Eisman fears that the American banking landscape could soon resemble Canada’s, where a small group of national banks dominate the market. “I don’t want to be Canada,” he warned. “It’s basically a cartel, and so therefore those banks get to charge a lot more to customers.”

In Canada, the banking sector is largely controlled by five major institutions, known colloquially as the “Big Five.” While this model is praised for its stability, critics argue that it leads to limited competition, fewer innovations, and higher consumer fees. Eisman’s comments suggest that a similar outcome could be unfolding in the U.S. if regulatory and competitive pressures remain unaddressed.

This potential “cartelization” of U.S. banking carries significant implications. Fewer, larger banks mean reduced competition, which often translates to higher costs for services such as checking accounts, credit cards, and loans. It could also result in more rigid lending criteria, limited access to financial services in rural or underserved communities, and diminished responsiveness to consumer needs.

Eisman’s warning comes amid renewed debates over the structure of the U.S. financial system. Some policymakers have pushed for tighter regulation of large financial institutions to prevent another crisis akin to 2008. Others argue that more consolidation is necessary to keep pace with evolving technological demands and to ensure that American banks remain globally competitive.

While views differ on the ideal path forward, Eisman’s central message is clear: the current status quo benefits only the largest players. Without regulatory reform that allows healthy consolidation among regional banks—or efforts to ease the technological and compliance burdens on smaller institutions—the U.S. could be left with a dangerously narrow set of financial gatekeepers.

His message also resonates with critics who argue that large banks wield disproportionate influence over the economy and political system. The COVID-19 pandemic further underscored these concerns, as government relief programs were funneled predominantly through large banks, giving them even greater visibility and consumer reliance.

For everyday Americans, the stakes are real. The more the market consolidates, the less leverage consumers have to demand better rates, lower fees, or innovative services. As Eisman warns, unless mid-tier banks are given a lifeline through strategic mergers or regulatory relief, they may “wither on the vine.”

The implications stretch beyond economics. Banking access is often tied to broader issues of equity and inclusion. Community banks and regional lenders frequently serve niche markets, including small businesses and local neighborhoods, that might otherwise be overlooked by national chains. As these institutions shrink or disappear, those communities risk being left behind.

Ultimately, Eisman’s warning is not merely a prediction—it’s a call to action. Policymakers, regulators, and industry leaders must reckon with the mounting concentration of financial power and the potential consequences for market competition, innovation, and consumer choice.

In a world where just a few institutions could soon control the lion’s share of American deposits, the time to ask hard questions—and to explore bold solutions—may be now.

News

WNBA Coach Ejected After Shocking On-Court Confrontation Following Controversial Non-Call

The air in the arena was thick with frustration and the kind of tension that can only build in the…

THE UNANNOUNCED EXODUS—WHO GOT BOOTED FROM ‘THE FIVE’ AS SANDRA SMITH TAKES OVER IN SHOCKING POWER GRAB?

The world of cable news, a landscape already defined by its daily turmoil and high-stakes drama, has been sent into…

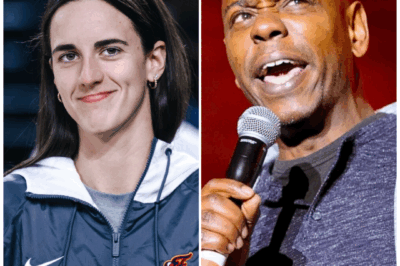

Don’t get so caught up in Caitlin Clark’s hype that you forget about another WNBA sensation – JuJu Watkins!

In the electrifying universe of women’s basketball, two names are spoken with reverence, fear, and an almost religious fervor: Caitlin…

More Than A Win: A’ja Wilson’s Shocking Candor Reveals The Standard of a Champion

Victory in sports is supposed to be simple. It’s a binary outcome—a mark in the win column, a step up…

A Champion’s Rebuke: A’ja Wilson’s Viral Comment Exposes the Uncomfortable Truth Behind a Winning Streak

In the carefully managed world of professional sports, athletes are often trained to speak in platitudes. They talk of giving…

A League in Denial: The Brutal Truth Behind the WNBA’s Battle for Respect

A Costly Charade: Why the WNBA’s Demands for Respect Ring Hollow For decades, the Women’s National Basketball Association has been…

End of content

No more pages to load