Tesla’s rollercoaster ride continues—and this week, it’s back on the upswing. After a six-day losing streak, the EV giant’s stock rebounded sharply, lifting its market cap once again above the coveted $1 trillion mark. But the question on everyone’s mind isn’t just “why the bounce?”—it’s “what happens next?”

Here’s the reality: Tesla’s second-quarter deliveries were down year over year and missed estimates. The numbers weren’t as bad as analysts feared, but they were far from reassuring. And with the U.S. EV tax credit of $7,500 soon disappearing, the company faces an uphill battle to hit its ambitious annual delivery targets.

So why are investors still buying in?

According to analysts like George Gianarikas from Canaccord Genuity, it’s not the auto business that’s keeping hope alive—it’s the promise of something bigger. “Robotaxis and Optimus are what’s driving the stock now,” he said, referencing Tesla’s upcoming autonomous vehicle initiative and humanoid robot project.

That optimism—pun intended—is fueling market enthusiasm, despite concrete results still being far off. Tesla has begun testing its robotaxi program in Austin, Texas, where social media influencers have been invited to experience the futuristic rides firsthand. While the buzz has been strong, real-world performance is mixed, and experts caution that one-off viral videos don’t equal commercial viability.

“The true challenge,” said CNBC’s Phil LeBeau, “is scaling it safely and consistently. You can post all you want, but until Tesla proves this tech works broadly and reliably, it’s just hype.”

And yet, hype is what Tesla does best.

Elon Musk has long been a master of leveraging media and fandom to keep momentum alive during lean periods. The same is happening now as Tesla fans focus less on declining sales and more on what could be: fleets of driverless taxis, AI-powered robots in homes and factories, and a new wave of lower-cost EVs poised to launch later this year.

Those affordable models—expected to debut before year-end—may offer a lifeline as the tax credit phases out. Analysts believe bringing EV prices into the $35,000 to $45,000 range could spark renewed demand in a sluggish U.S. market. But it’s still a tight timeline, and production ramps are never smooth.

Meanwhile, back on Wall Street, the Tesla valuation story is shifting. The “core believers,” as LeBeau calls them, are pricing the company not just as a carmaker, but as a tech platform with limitless upside—thanks to projects like Optimus and robotaxis that haven’t yet generated revenue.

Gianarikas keeps his feet firmly on the ground. “I’m a meat-and-potatoes kind of guy,” he said. “I care about earnings.” By his estimates, Tesla could hit $9 in non-GAAP EPS by 2027—if margins improve, deliveries rebound, and growth returns. That’s a tall order, but if it happens, and if robotaxis and Optimus start generating real results by 2030, “you can justify the stock here and even go higher.”

The bottom line: Tesla’s current valuation leans heavily on tomorrow, not today. Its most bullish backers are betting big on a future filled with self-driving fleets and AI workers—not sedans and SUVs. That vision may seem far off, even fantastical. But in a market driven by narratives as much as numbers, Tesla’s future remains one of the boldest—and riskiest—bets on the board.

News

WNBA Coach Ejected After Shocking On-Court Confrontation Following Controversial Non-Call

The air in the arena was thick with frustration and the kind of tension that can only build in the…

THE UNANNOUNCED EXODUS—WHO GOT BOOTED FROM ‘THE FIVE’ AS SANDRA SMITH TAKES OVER IN SHOCKING POWER GRAB?

The world of cable news, a landscape already defined by its daily turmoil and high-stakes drama, has been sent into…

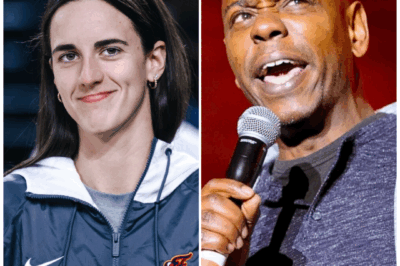

Don’t get so caught up in Caitlin Clark’s hype that you forget about another WNBA sensation – JuJu Watkins!

In the electrifying universe of women’s basketball, two names are spoken with reverence, fear, and an almost religious fervor: Caitlin…

More Than A Win: A’ja Wilson’s Shocking Candor Reveals The Standard of a Champion

Victory in sports is supposed to be simple. It’s a binary outcome—a mark in the win column, a step up…

A Champion’s Rebuke: A’ja Wilson’s Viral Comment Exposes the Uncomfortable Truth Behind a Winning Streak

In the carefully managed world of professional sports, athletes are often trained to speak in platitudes. They talk of giving…

A League in Denial: The Brutal Truth Behind the WNBA’s Battle for Respect

A Costly Charade: Why the WNBA’s Demands for Respect Ring Hollow For decades, the Women’s National Basketball Association has been…

End of content

No more pages to load